Tag: defer

-

When Is Tax Due on Series EE Savings Bonds?

You may have Series EE savings bonds that were bought many years ago. Perhaps you store them in a file cabinet or safe deposit box and rarely think about them. You may wonder how the interest you earn on EE bonds is taxed. And if they reach final maturity, you may need to take action…

-

You May Be Able to Save More for Retirement in 2019

Retirement plan contribution limits are indexed for inflation, and many have gone up for 2019, giving you opportunities to increase your retirement savings: Elective deferrals to 401(k), 403(b), 457(b)(2) and 457(c)(1) plans: $19,000 (up from $18,500) Contributions to defined contribution plans: $56,000 (up from $55,000) Contributions to SIMPLEs: $13,000 (up from $12,500) Contributions to IRAs:…

-

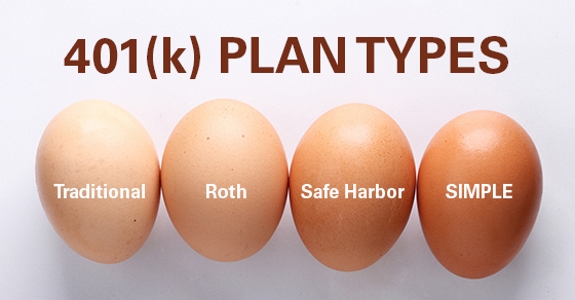

Finding a 401(k) that’s Right for Your Business

By and large, today’s employees expect employers to offer a tax-advantaged retirement plan. A 401(k) is an obvious choice to consider, but you may not be aware that there are a variety of types to choose from. Let’s check out some of the most popular options: Traditional. Employees contribute on a pre-tax basis, with the…